U.S. Labor Market Delivers a June Surprise with 147,000 New Jobs, Offering Mixed Signals for the Economy

- Jul 5, 2025

- 3 min read

5 July 2025

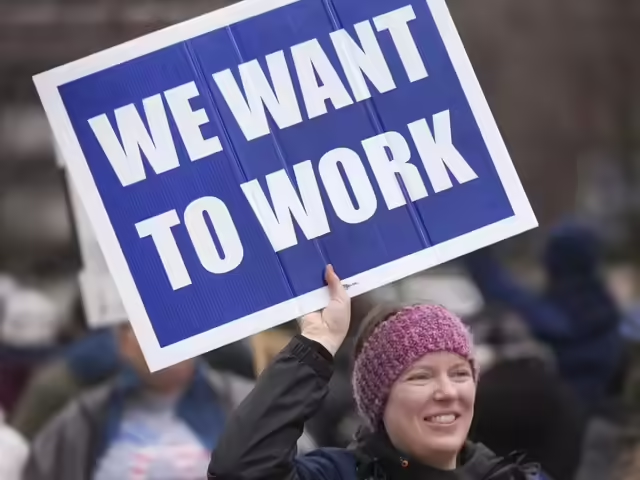

June brought a welcome surprise to the U.S. labor market, with the addition of 147,000 new jobs significantly more than the 118,000 most economists had projected while the unemployment rate slid to 4.1 percent, down from 4.2 percent in May. On the surface, the report paints a picture of strength and continued resilience in employment. Beneath the headline, however, lies a more nuanced narrative: concentrated gains in public sector hiring, cooling in private‑sector employment, and signs that policy pressures are reshaping the labor landscape.

The U.S. Bureau of Labor Statistics confirms that total nonfarm payroll employment expanded by 147,000 in June, aligning with recent averages but exceeding expectations. Monthly revisions further bolstered optimism, adding a combined 16,000 jobs to April and May suggesting that the economy has consistently outperformed initial estimates.

Healthcare and public-sector employment, including state and local government, were primary contributors to job creation. Healthcare roles increased by approximately 39,000, and state government hiring grew by 47,000 jobs, with local government education adding another 33,000. These gains underscore a persistent demand in public welfare and healthcare sectors, where labor needs appear stable and predictable.

By contrast, private‑sector hiring showed signs of slowing. Only 74,000 private‑sector positions were gained during the month, marking the smallest monthly increase since October 2024. This conservative pace mirrors broader reports of headwinds in industries reliant on immigrant labor and sensitive to international policy shifts. A notable number of discouraged workers rose sharply to 637,000, up 256,000 from May, suggesting a growing sense of disillusionment among jobseekers.

The civilian labor force contracted as well, shrinking by a further 130,000 participants in June. Analysts interpret this decline as partly caused by fear of immigration crackdowns, as potential workers particularly foreign‑born opt to stay out of the job market amid heightened enforcement pressure . Such a contraction can artificially suppress the unemployment rate, since it counts fewer people as unemployed. The unemployment figure of 4.1 percent thus reflects a diminishing base as much as it does actual job gains.

Earnings data added another layer of insight. Average hourly wages rose by 0.2 percent month‑over‑month and by 3.7 percent year‑over‑year. While wage growth remains above a comfortable benchmark of 3.5 percent seen as consistent with the Federal Reserve’s target interest rate, the modest monthly increase suggests some tempering of inflationary pressure.

Manufacturing, often viewed as a bellwether for economic health, contracted again. Employment in manufacturing declined for the second straight month, reinforcing concerns of a sector in retreat. Similarly, professional services and business roles showed limited growth, highlighting areas of uneven momentum across the private economy.

The Federal Reserve, watching all this closely, is likely to interpret these dynamics as justification for delaying any further interest rate cuts. Futures markets have substantially reduced the likelihood of a rate cut in July from around 24 percent to under 7 percent. While inflation is easing, it remains above target, and the current strength in payrolls weakens the case for immediate policy easing.

Markets responded notably to the news. The S&P 500, Nasdaq, and Dow Jones Industrial Average rallied, with the Dow climbing 344 points toward its all‑time high. Investors are showing renewed interest in corporate earnings, as attention shifts from macroeconomic policy to the performance of individual companies.

Looking forward, economists caution that the job market may soon cool further. Wave of tariffs, uncertainty in trade policies, and reduced immigration driven by policy enforcement could continue to cool hiring. Wells Fargo economist Sarah House warned that beneath the surface, market indicators “didn’t look quite as good as first meets the eye”.

For Americans navigating this evolving labor landscape, stories like that of Derek Wing, a communications manager laid off in Seattle, highlight the personal challenges behind the data. He described an initial phase of silence and uncertainty that eventually gave way to a swift new opportunity, reminding us that even in a fragile market, resilience and adaptability can prevail.

In the end, the June job report presents a portrait of cautious optimism. Strong headline job growth and wage gains are tempered by undercurrents of private‑sector stagnation, labor‑force withdrawal, and firming policy lines from the Fed. Policymakers and investors alike must carefully weigh these cross‑currents as they chart a course through a year of persistent uncertainty.

Comments